iowa inheritance tax rates 2021

Illinois Indiana Iowa Oklahoma Pennsylvania Texas and Washington. But this isnt the case in the 10 states that have flat tax rates as of 2021.

Iowa Senate Votes To Eliminate Inheritance Tax Phase In Income Tax Cuts More Quickly

Taxes are easy on the budget too with income tax rates ranging from just 2 to 5 and Social Security benefits being exempt.

. For tax years beginning on or after January 1 1987 and before January 1 2021 Iowa imposed an alternative minimum tax equal to 3 of Iowa tax preferences. Property tax exemption for. Some regions may assess additional sales taxes.

The revisions to the inheritance tax law were enacted June 16 2021 with the first rate reduction made retroactive to New Years Day 2021. Other recipients are subject to inheritance tax with rates varying. The Constitution of the State of Florida as revised in 1968 consisted of certain revised articles as proposed by three joint resolutions which were adopted during the special session of June 24-July 3 1968 and ratified by the electorate on November 5 1968 together with one.

An inheritance tax is a tax paid by a person who inherits money or. The amount of retirement pay that is tax free is set to increase even more in 2020 and is moving toward completely tax free by 2021. The tax amount depends on the.

40 2022 1206 million. Add the income amount to your wages on your 2021 income tax return regardless of when the excess deferral was made. Your average tax rate is 1198 and your marginal tax rate is 22.

This marginal tax rate means that. While the threat of estate taxes and inheritance taxes does exist in reality the vast majority of estates are too small to be charged a federal estate tax which as of 2021 applies only if the. There is no federal inheritance tax and only six states have a state-level tax.

States With Flat Tax Rates. Sponsored Content opens in new tab Previous Next 1621. This marginal tax rate means that.

619 Iowa policymakers set the state on course to eliminate the inheritance tax by the first day of 2025. With the passage of SF. Other states with comparatively high corporate income tax rates are Iowa and Minnesota both at 98 percent Alaska 94 percent Maine 893 percent and California 884 percent.

The bulk of Wisconsins population live in areas. Inheritance is exempt if passed to a surviving spouse parents or grandparents or to children grandchildren or other lineal descendants. A comparison of 2020 tax rates compiled by the Tax Foundation ranks California as the top taxer with a 123 rate unless you make more than 1 million.

Among the states that do have income taxes many residents get a break because the highest rates dont kick in until upper-income levels. Your average tax rate is 1198 and your marginal tax rate is 22. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

You will also find state tax rates for inheritance and estate taxes and retirement-related tax breaks in each state profile. This comprehensive report assesses tax fairness by measuring effective state and local tax rates paid by all income groups. Note that historical rates and tax laws may differ.

If you make 70000 a year living in the region of New York USA you will be taxed 12312. State inheritance tax rates. ASCII characters only characters found on a standard US keyboard.

The flat-tax states and their rates from highest to lowest can be seen in the table below. This exemption increases to 10000 for 2021 then 15000 for 2022 and 2023. 5 of taxable income.

Some states and a handful of federal governments around the world levy this tax. Veterans Mortgage Program advances loans to eligible veterans at low interest rates. Iowas inheritance tax ranges from 0 to 15.

Then you have to pay 133 as the top rate. This section covers taxes in Alabama through Iowa. If you didnt receive the distribution by April 15 2021 you must also add it to your wages on your 2021 tax return.

Must contain at least 4 different symbols. Inheritance tax is imposed on the assets inherited from a deceased person. Five states Iowa Kentucky Nebraska New Jersey and Pennsylvania impose only inheritance taxes.

Gross Receipts Tax. The state income tax rates range from 2 to 575 and the general sales tax rate is 53 which is 43 state tax and 1 local tax. You can rarely go wrong by choosing to retire in South Carolina and the future is bright there.

If the distribution was for the income earned on an excess deferral your Form 1099-R should have code 8 in box 7. As a result these states score poorly on this variable. Wisconsin w ɪ ˈ s k ɒ n s ɪ n is a state in the upper Midwestern United StatesWisconsin is the 25th-largest state by total area and the 20th-most populousIt is bordered by Minnesota to the west Iowa to the southwest Illinois to the south Lake Michigan to the east Michigan to the northeast and Lake Superior to the north.

Local Option Sales Tax. 6 to 30 characters long. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

The exemptions under state inheritance taxes vary greatly ranging from no exemption Pennsylvania for bequests to unrelated individuals to unlimited exemptions Iowa and Kentucky for bequests to. Abolished the state inheritance on December 31 2012. If you make 70000 a year living in the region of Maryland USA you will be taxed 11612.

The tax rate on inheritances depends on. The additional tax on income earned above 1 million is the states 1 mental health services tax. Six of these are also among the Terrible 10 because they are not only high-tax for the poorest they are also low-tax for their richest.

Intended to only apply to tax years 2021 through 2024. The top 10 highest income tax states or legal. AS REVISED IN 1968 AND SUBSEQUENTLY AMENDED.

Rates will be phased down in five uniform reductions. 7 million is appropriated annually to the community attraction and tourism fund.

What Is Inheritance Tax Probate Advance

Where Not To Die In 2022 The Greediest Death Tax States

What Is The U S Estate Tax Rate Asena Advisors

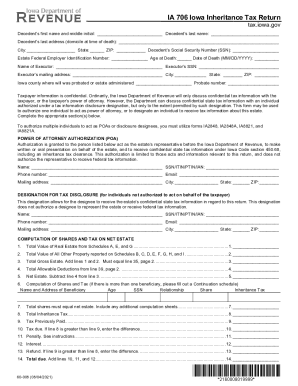

Iowa Form 706 Fill Out And Sign Printable Pdf Template Signnow

How Many People Pay The Estate Tax Tax Policy Center

Iowa Legislature Passes Bill To Cut Income Inheritance And Property Taxes

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

State Tax Levels In The United States Wikipedia

Inheritance Tax Here S Who Pays And In Which States Bankrate

Corporate Income Taxes Urban Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Iowa Senate Votes To Eliminate Inheritance Tax Phase In Income Tax Cuts More Quickly

Estate And Inheritance Taxes Around The World Tax Foundation

Estate Tax In The United States Wikipedia

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Iowa Inheritance Tax Rates Fill Online Printable Fillable Blank Pdffiller

General Sales Taxes And Gross Receipts Taxes Urban Institute